05 Mar 2019

How to become a millionaire by the age of 65

Fancy becoming a millionaire by the age of 65?

The thought is obviously very attractive, though most of us think such wealth is way beyond our reach.

However, investment platform AJ Bell says it is possible if you start putting away just £78 a month from the age of 22.

The company said long-term savings might not be a top priority for millennials - with paying off student loans, starting a career and getting on the housing ladder all vying for attention.

But starting the savings habit as early as possible means even modest amounts put aside each month could turn into a fortune with the magic of compound growth over the years.

Individual Savings Accounts (ISAs) and particularly the Lifetime ISA (LISA) are said to be a good option for millennials because they are simple, tax-efficient and offer a Government bonus for people under 40.

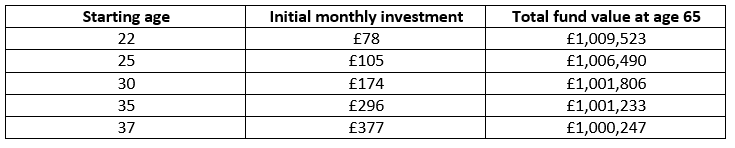

The table below shows how much millennials need to start saving per month to become an ISA millionaire by the time they are 65.

The above figures assume savers increase contributions each year in line with the Government’s long-term inflation target of 2% and take advantage of the Government bonus available via the Lifetime ISA as much as possible, using a normal ISA once they have exceeded the LISA limit.

Laura Suter, a personal finance analyst at AJ Bell, has outlined a four-step plan that can help millennials become millionaires.

She said: “The beauty with ISAs is that once money is in the account there is no income or capital gains tax to pay, so they are a simple way to save for the long term. The money can be accessed at any time should you need it, but if you can leave it untouched and be patient it is possible to turn yourself into an ISA millionaire following these four steps.”

1. Start early

ISAs are not a get-rich-quick scheme, but they can help you create a fortune if you contribute regularly over the long term.

2. Increase contributions as earnings grow

The key here is to invest what you can realistically afford and increase that gradually over time. No one wants to invest so much that they don’t have any money left to live life today.

3. Get some help from the Government

The newest member of the ISA family is the Lifetime ISA which offers a 25% Government bonus. You have to be under 40 to open a Lifetime ISA, but if you are eligible and are happy to keep your money working for you until at least 60 the Lifetime ISA can turbo-boost your ISA savings.

4. Take some investment risk

Choosing how and where to invest your ISA savings has a significant impact on the amount of money you can accumulate. With cash savings rates hovering around 1% to 2%, a 22-year-old would have to keep saving until they are 100 to become a millionaire (assuming an interest rate of 1.5% per annum).

Investing in the stock market does involve taking risk, but over the very long term shares have delivered very strong investment returns compared to other types of investment. The MSCI world index, which represents the performance of shares around the planet, has delivered an average annual return of 11% over the past 40 years if you include all dividends being reinvested.

Speak to an expert

If you would like to speak to one of our independent financial advisers about your investment strategy, click here.