22 Nov 2017

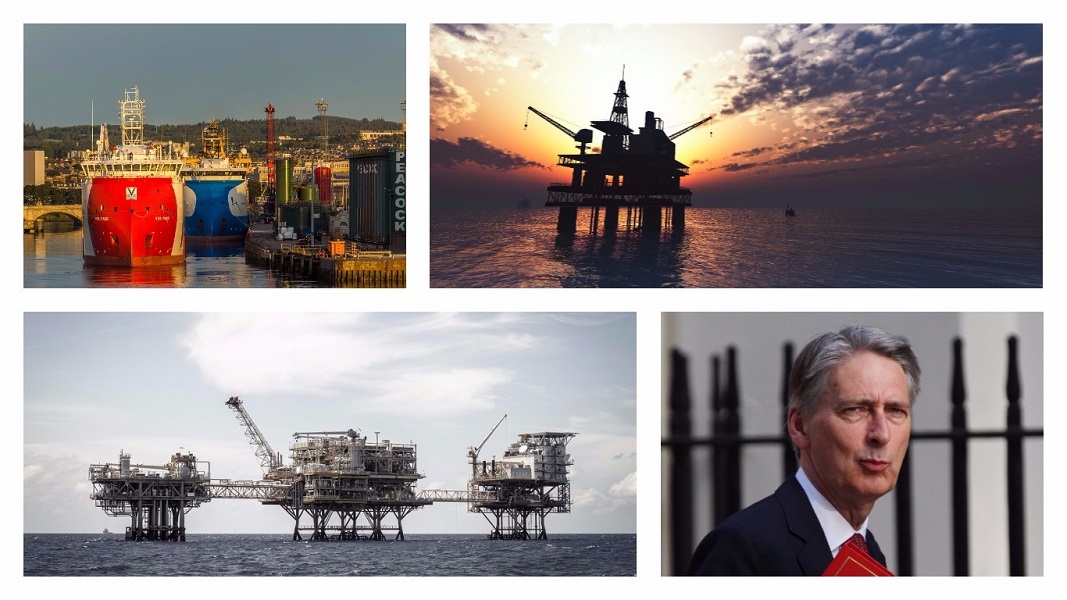

Budget 2017: Vital tax break for Aberdeen's oil sector

The North Sea oil and gas industry has hailed today’s tax move by Chancellor Philip Hammond as a “vital step” with the potential to lead to tens of billions of pounds of new investment in the basin.

The news has been widely welcomed in Aberdeen, the oil capital of Europe, which has been badly hit by the recent downturn in the offshore business.

Mr Hammond announced in the Commons that the UK Government will introduce transferable tax histories for oil and gas fields moving into fresh ownership.

He said this innovative tax policy will encourage new entrants to bring fresh investment to a basin that still holds up to 20billion barrels of oil.

Tens of thousands of energy industry jobs – many of them in Aberdeen and other areas of Scotland – have been lost in recent years following the nosedive in the oil price.

Revival

It is hoped that the Chancellor’s tax move could lead to a significant revival of the North Sea business.

Deirdre Michie, chief executive of industry body Oil & Gas UK, said: “We very much welcome the Chancellor’s action to enable the implementation of transferable tax history.

“This is a vital step that can bring in new investment to increase recovery from existing fields and fund fresh investment which is key to generating activity for our hard-pressed supply chain. It will also help extend the lives of many mature fields and postpone decommissioning.

“While there have been a number of deal announcements in the basin over the last year, these have mostly been for less-mature assets, have been extremely complicated and taken a very long time to negotiate. This tax measure should help complete deals more quickly and in a more efficient way.

“Prolonging the life of mature assets better allows the industry to deploy its skills and technology to maximise extraction of the UK’s oil and gas, increasing production tax revenues to the Exchequer and securing highly-skilled jobs.

“We note the measure is intended to be effective by November 2018 and are committed to work closely with Treasury to ensure the change delivers the intended outcome.”

Asset trading

Currently, existing owners of oil and gas fields are unable to transfer their tax history onto a buyer.

This can make a field less attractive commercially to a potential new operator as they are unlikely to be able to access the same level of tax relief than the current owner when decommissioning.

Allowing the transfer of tax history removes a significant barrier to asset trading.