13 May 2019

Aberdein Considine launches free consumer debt advice service

National law firm Aberdein Considine has launched a free debt advice service as part of an ongoing programme of support for consumers.

Aberdein Considine currently works with a number of UK lenders in relation to different types of debt recovery and has developed a range of models to assist borrowers in managing debt, in particular those experiencing financial difficulty.

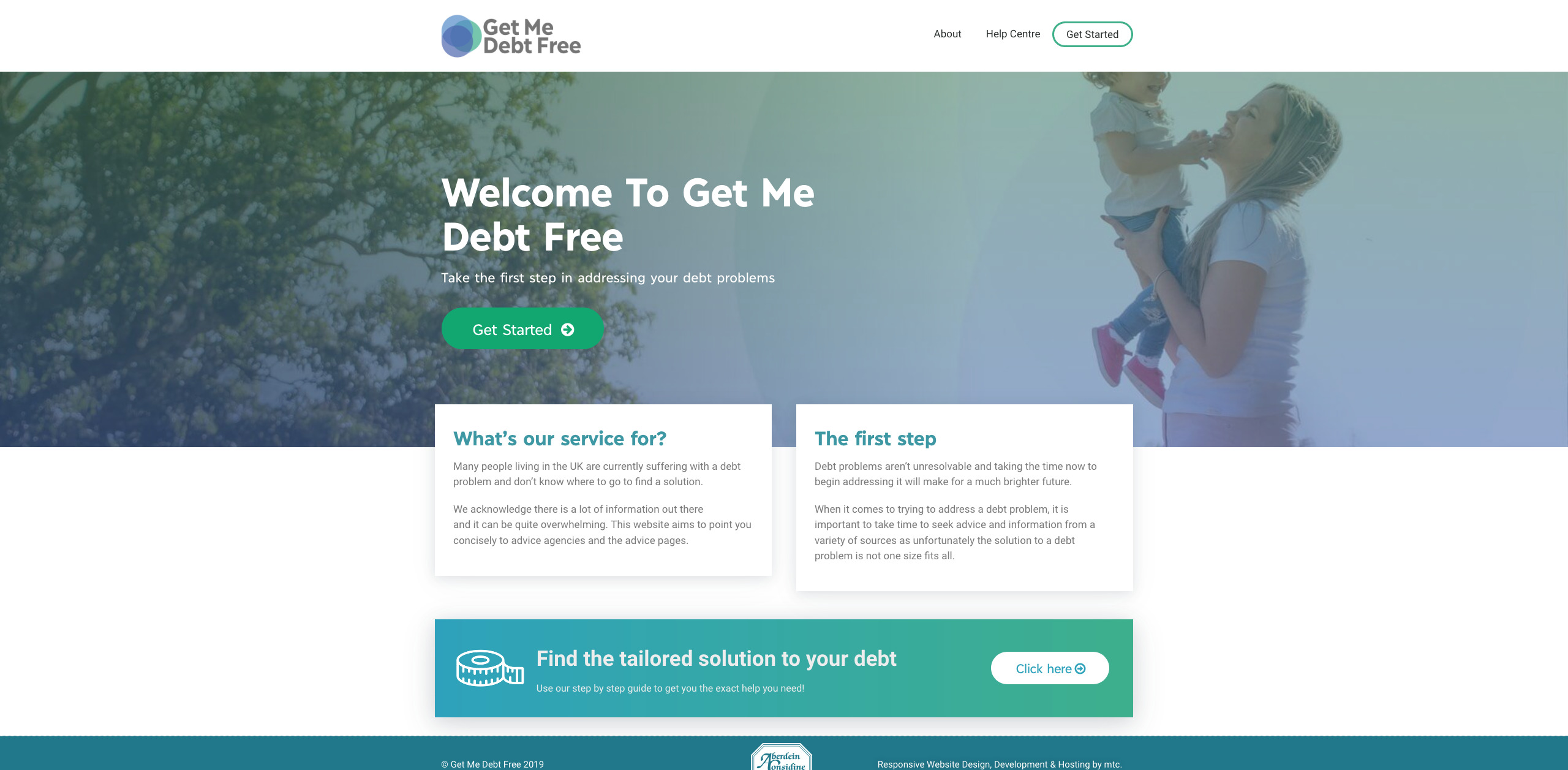

The new advice service called getmedebtfree.com is a website designed to help consumers with all types of debt issues, irrespective of where they live or who has been asked to manage their debt.

The site is a comprehensive advice tool, where users answer three simple questions, and the algorithm generates a fully tailored response based on their location and the nature of their debt, be it secured or unsecured.

No personal data is captured and it will provide those with debt issues with free assistance at any stage of the process, with the aim that they are able to deal with any difficulties in a more informed manner.

The site will guide individuals through the recoveries process, which can differ depending on where you are in the UK, and it will also direct users to a variety of resources which can provide assistance in helping to get any money issues under control.

Aberdein Considine has recently added additional governance and expertise to the litigation process, particularly in cases which have been identified as having an increased potential for vulnerable circumstances.

Furthermore, all staff have received training from the NHS on assisting and working with vulnerable customers.

Financial education has also been a specific focus for the firm, which will help young people to understand the possible risks of accumulating unmanageable debt. In the last three years Aberdein Considine has invested in excess of £10,000 to deliver money management lessons for schools in various parts of the country including subjects such as how mortgages, credit cards and interest rates work. In addition, special “Maths into Finance” sessions have taken place, teaching secondary school pupils about domestic budgeting, pensions and tax, as well as borrowing and managing debt.

Commenting on the new debt management service Myra Scott, Partner and Head of the Lender Services Practice Group at Aberdein Considine said:

“Financial difficulty can be a source of significant stress for individuals and their families and it is vital that both lenders, and those working with borrowers meet the highest standards of service and provide the necessary support at all times.

It is not in anyone’s interests for borrowers to be experiencing difficulty in managing debt and the new site provides an additional tool to help those who may either simply want more guidance on financial issues, or those who are already going through a recovery process.”

If you're struggling with debt, help is available

Find out more about the advice offered at https://www.getmedebtfree.com.